The challenges societal changemakers will face in the future are increasingly broad, uncertain, and entangled. In order to tackle these systemic challenges, we have to innovate how we innovate by shifting the focus from parts to partnerships. This article will elaborate on the discussions at the Waves Summit 2024 regarding the polycrisis and systemic investing as an approach to tackling it as well as their relevance to Laurea’s work on innovation management and ecosystems.

Photo by Mikael Seppälä/DALL-E

Photo by Mikael Seppälä/DALL-E

A study of the 50-year historical development of R&D has shown that the context of R&D activities has broadened over time. In recent years, the context of R&D activities has been increasingly characterised by global disruptions (such as climate change, wars and pandemics) and responses to sustainable development. (Ferrigno et al. 2023.)

This topic was the focus of the Waves Summit – Forum For Changemakers in Helsinki in April 2024, which I had the opportunity to attend. The Summit featured many leading international and national speakers. In this article, I will present some of the ideas presented at the conference that inspired me and that are relevant to my work at Laurea University of Applied Sciences on innovation management and ecosystems.

The polycrisis challenges our notion of innovation

One of the speakers I was most looking forward to hearing was Daniel Schmachtenberger who is the founder of the Civilization Research Institute (CRI) that is a think tank focused on addressing global systemic risks and promoting sustainable, resilient forms of governance and society. At the heart of Schmachtenberger’s fireside talk at the Waves Summit were the concepts of polycrisis and metacrisis and their implications for how we innovate.

Schmachtenberger described the polycrisis as a convergence of multiple global crises that are interrelated and mutually reinforcing, making them more complex and difficult to resolve. These crises span multiple domains, including environmental, economic, political, technological, and social issues. The concept seeks to suggest that the totality and interconnectedness of these crises create a situation that is more severe and complex than any individual crisis.

Schmachtenberger used the concept of metacrisis to refer to the underlying systemic and fundamental issues that have created the polycrisis, which represent a deeper level of challenges. Schmachtenberger posited that the metacrisis is about the inadequacy of our existing institutions, systems of governance, and collective sense-making mechanisms to effectively address and manage the complexities of the polycrisis. It is about the failure of our current socio-economic, political and cultural paradigms to deal with these overlapping crises in a coherent and sustainable way.

Schmachtenberger’s framing of the challenges we face today emphasised the need for fundamental changes in how we think, govern, and organize society to address these intertwined challenges effectively. The key implication of Schmachtenberger’s framing is that we have to innovate how we innovate. One pair of ideas he introduced was the need for an ecology of solutions that is attentive to the metacrisis and can address the constitutive elements that give rise to the polycrisis.

From my perspective the main contribution of Schmachtenberger’s talk at the Waves Summit was not necessarily to point the practical ways innovation should be innovated but rather present the broader context of why it should be done.

Partnerships are at the heart of transformative innovation

So the practical question is: how should we innovate to address the polycrisis? Based on many of the speeches at Waves, it seems that partnerships, and the different kinds of skills and capabilities needed to make the most of partnerships in different contexts, are key to innovating in response to ever-greater challenges.

For example, in the “From Super Heroes to Social Movements” panel Jan Artem Henriksson of the Sweden-based Inner Development Goals organisation made the important point that changemakers need to move from being activists to being collaborators and partners with those they want to influence. According to Henriksson, the point is not to judge and condemn those who don’t operate from the activist’s values but rather to be able to collaborate with those who do not share them. Inner Development Goals aim to foster the internal and relational conditions for collaboration through five themes and a set of practices related to them. Henriksson introduced the five themes of Inner Development Goals, which are:

- nurturing a healthy relationship with oneself (BEING)

- enhancing cognitive skills for better thinking (THINKING)

- fostering care for others and the world (RELATING)

- developing social skills for effective collaboration (COLLABORATING), and

- taking actions that enable positive change (ACTING).

But where should the skills needed for collaboration be applied to address the polycrisis that is so broad that it cannot be addressed in the relationships we are all embedded in? Dominic Hofstetter, the Executive Director of the TransCap Initiate, highlighted the need for systemic investing in supporting transformative innovation.

Systemic investing fosters the conditions for multi-organisational collaboration

The ability to purposefully combine different forms of capital is key to fostering the creation of low-carbon, climate-resilient, equitable and inclusive societies – approaches that are being used to tackle the polycrisis. In the ”The financing systems are changing – how can our financing models enable systemic impact?” panel, Hofstetter was joined by impact investor Annika Sten Pärson of The Inner Foundation and entrepreneur Jimmy Westerheim of The Human Aspect. The panel was built around presentations from all three.

According to Hofstetter (2020), the key point of systemic investing is to deploy capital with the intention of catalysing directional, transformative change in socio-technical systems. This approach resides at the nexus of systems thinking and investment practice, advocating for a systemic investment approach that sees the world as a complex adaptive system, and aims to catalyse sustainability transitions in the real economy.

In his presentation Hofstetter made a compelling case for systemic investing, a concept that goes beyond the confines of traditional finance to address the multifaceted challenges posed by climate change and sustainability.

Hofstetter emphasized the limitations of technological solutions in isolation, using the example of how advances in propulsion from petrol to electricity or hydrogen haven’t solved the systemic problem of traffic congestion. This illustrates a broader point: systemic problems require systemic partnerships. He also advocated extending investment horizons to 10-15 years to support the long-term nature of system transformation and ensure that investments have a lasting impact on the system they are intended to support.

In addition to creating partnerships between capitals, Hofstetter outlined a funding architecture that strategically aligns capital with the timing and specific needs of systems change initiatives. This architecture not only serves the right type capital at the right time but also leverages the right ways to use capital to create combinatorial effects to create synergies that emerge from a thoughtful composition of innovation experiments. This thought is very close to Schmachtenberger’s idea of an ecology of solutions.

Systemic investing is not only about allocating different forms of capitals in partnerships but also about creating deep understanding of the systems themselves, including identifying the capabilities that are missing from the system and preventing it from functioning effectively. Through research, prototyping, and field building, systemic coordination is supported by different forms of capital designed for systemic change. This requires the creation of spaces where investors representing many forms of capital work with practitioners to foster exchange focused on the needs of the systems themselves and the partnerships needed to address them.

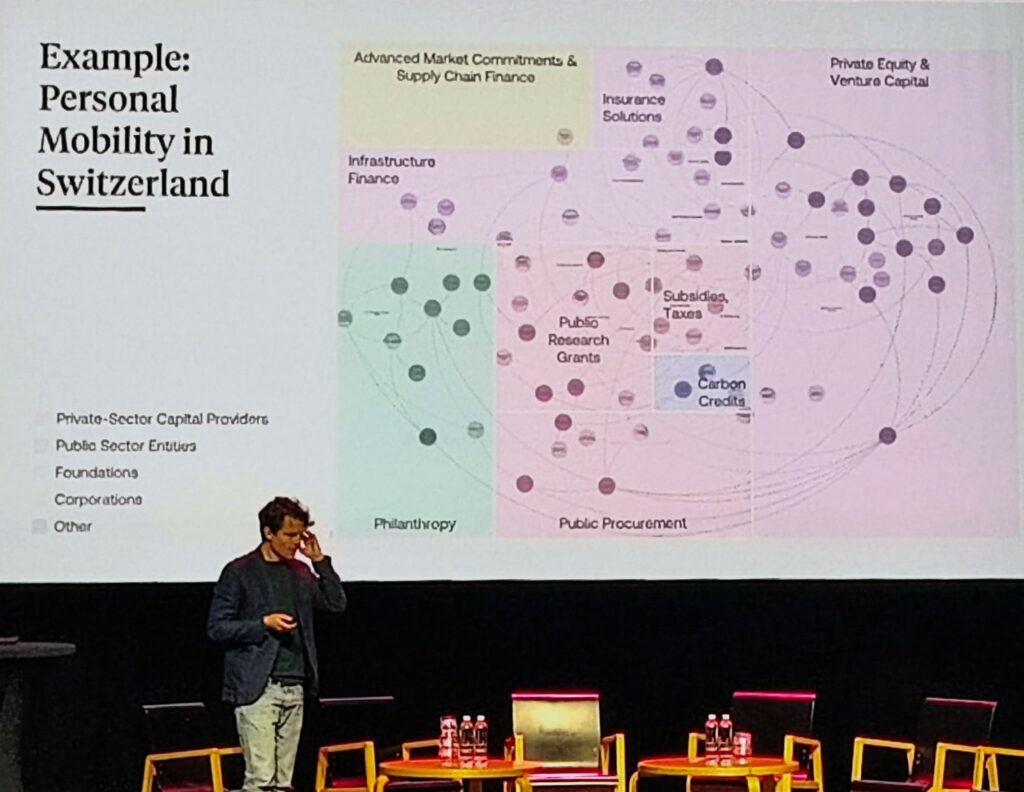

Picture 1. Dominic Hofstetter presenting an outline of multiple forms of capital identified to shift the different parts of the personal mobility system in Switzerland. (Photo: Mikael Seppälä).

Picture 1. Dominic Hofstetter presenting an outline of multiple forms of capital identified to shift the different parts of the personal mobility system in Switzerland. (Photo: Mikael Seppälä).

Hofstetter also introduced the TransCap Initiative that is a collaborative innovation space designed to support the development, experimentation, and scaling of systemic investing. The organisation’s development pathway aims to manage millions in the early stages of innovation, connect billions through scaling out strategies, and eventually inspire trillions through scaling up to create a new normal by supporting the development of a global movement to advance the systemic investment approach.

Hofstetter mentioned his goal that in about 10 years’ time, systemic investment will hopefully be as developed as the impact investing approach is today, but there are still many issues to be addressed. The development of funding partnerships is crucial in this new investment logic. Such partnerships will be the crucible for innovation, blending expertise from diverse fields to drive progress. Impact measurement and metrics (IMM) are evolving to reflect the systemic nature of the investments, measuring not only financial returns but also societal and environmental impacts.

To address the polycrisis, Hofstetter suggested that funders’ evaluation processes should evolve to support system complexity: moving away from ticking boxes for individual Sustainable Development Goals (SDGs) to understanding the connections between them. For example, linking personal mobility to health promotion, or mental health to urban planning, can help us develop innovative place-based systemic solutions.

I left the event impressed by the many maturing initiatives that are strengthening the skills and capabilities of societal actors to tackle the wicked problems of our times. I also felt inspired that the work we are doing in the Laurea University of Applied Sciences in advancing systemically informed innovation management and ecosystem orchestration seems highly relevant and timely in relation to what is happening globally.

One of the main implications I would highlight from the summit’s “we have to innovate how we innovate” call to action to the work we are doing at Laurea includes shifting our focus from business, product and service innovation to systems innovation. As the activities of single actor, team or organisation will not suffice in dealing with the polycrisis, we need long-term partnerships between organisations. It is not enough for these partnerships to co-create solutions but also 1) identify shared challenges and embrace collaborative governance, 2) created shared and actionable knowledge and, in the lines of Hofstetter’s ideas on systemic investing, 3) use hybrid funding and portfolio management to fund and lead the composition of innovation experiments or ecologies of solutions (Seppälä 2023).

About the author

M. Soc. Sci., M. Sci. (Economics), MA (Adult Education), MBA (Service Innovation and Design) Mikael Seppälä is an expert in systemic innovation management and ecosystems orchestration who works as a project manager at the Laurea University of Applied Sciences.

Sources

- Ferrigno, F., Crupi, A., Di Minin, A. & Ritala, P. 2023. 50+ years of R&D Management: a retrospective synthesis and new research trajectories. R&D Management 53:5, p. 900-926.

- Hostetter, D. 2020. Transformation Capital – Systemic Investing for Sustainability. White paper.

- Seppälä, M. 2023. Sociology and Ecosystems Orchestration – From exploring multiple perspectives to engaging them in sustainability practices. Laurea Journal.

- Waves Summit. 2024. Waves Summit – Forum For Changemakers. Kulttuuritalo, Helsinki 3-4.4.2024. WWW-page. Accessed 7.4.2024.